Client challenge

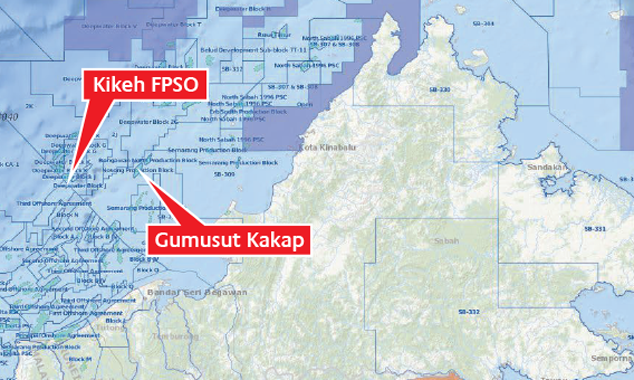

Murphy Oil was offering a non-operated stake in its portfolio of producing assets and development projects offshore Malaysia. The portfolio included a share in the shallow water Sarawak oil and gas developments, the Kikeh floating production storage and offloading vessel (FPSO) development, the Gumusut Kakap semi-submersible development and an interest in a future floating liquefied natural gas (FLNG) development.

We were contracted to conduct a technical due diligence study, covering subsurface, facilities, wells and HSE aspects on behalf of a bidder. The number of assets and future developments required a significant volume of information to be reviewed and interpreted in a tight timescale. Furthermore, strict rules regarding the use and reproduction of data needed to be met. Liquidation of the scope in the time available required coordinating both facilities and subsurface resources in Kuala Lumpur, Perth, London and Aberdeen.

How we helped

We provided an independent assessment and verification of the technical elements of the portfolio. We focused on the following areas for this due diligence exercise:

-

review and technical assessment of the existing facilities and the planned and ongoing development projects

-

integration of subsurface, facilities and drilling study findings to give a range of development scenarios

-

assessment of future capital expenditure (CAPEX), drilling expenditure (DRILLEX), operational expenditure (OPEX) and abandonment expenditure (ABEX) profiles for each scenario for use in economic modelling

-

identifying key technical risks and uncertainties

-

assessing health, safety and environmental (HSE) exposure and regulatory compliance requirements.

Business benefits

Our assessment identified the key technical risks associated with delivering the production profiles and cash flows. By integrating subsurface and facilities elements, our client had a range of reservoir scenarios and associated cost profiles. This provided a full understanding of the investment upside and helped shape a well-informed, commercial strategy.

Our assessment identified the key technical risks associated with delivering the production profiles and cash flows. By integrating subsurface and facilities elements, our client had a range of reservoir scenarios and associated cost profiles. This provided a full understanding of the investment upside and helped shape a well-informed, commercial strategy.