With rising pressure from investors and new laws requiring more robust reporting, sustainability reports must evolve into what they should have been all along: a clear disclosure of a business’ risks and opportunities.

Amid the season of companies releasing their sustainability or “impact” reports, we are looking at where organisations might be getting it wrong. Sustainability reports have widely been critiqued as modes of PR rather than transparent accounts of a company’s ESG strategy and impact.

But with rising pressure from investors and new laws requiring more robust reporting, sustainability reports must now evolve into arguably what they should have been all along: a clear disclosure of a business’ risks and opportunities.

All Talk and No Action

Lack of transparency, greenwashing and inconsistencies – many of the issues with current reports lie within these realms. A Harvard Business Review report analysing 200 sustainability reports from 2022 revealed “a significant lack of nuanced discussions of trade-offs and priorities.” HBR reported:

“For example, many organisations produce a “materiality” matrix in these reports to identify crucial ESG issues, but most fail to distinguish between value-creating and ethical concerns, or between risk-reduction measures and strategic opportunities. They also focus as much on minor issues as existential threats. The result is “everything is material” maps that offer a laundry list of ESG issues and inspirational goals but have little credibility on the specifics of execution.”

The most important bit here: “Specifics of execution.” The new era of ESG has received some backlash as an all-talk-and-no-action concept. A new report from Fashion Revolution https://issuu.com/fashionrevolution/docs/fashion_transparency_index_2023_pages reviewing 250 of the world’s largest fashion brands and retailers on their level of public disclosure on human rights and environmental policies, practices and impacts showed many major fashion brands are disclosing information on their policies and processes, but not so much on their results and outcomes.

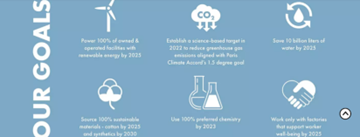

Image taken from a website of one of the lowest-scoring brands by Fashion Revolution, indicating the disclosures of goals without disclosing its results/impact.

Image taken from a website of one of the lowest-scoring brands by Fashion Revolution, indicating the disclosures of goals without disclosing its results/impact.

The highest-ranking brands in transparency still lack disclosures on critical issues, the report read. The review found brands were still falling short on reporting issues like social auditing, living wages, purchasing practices, unionisation, gender and racial equity, production and waste volumes, circularity, chemical use, deforestation and carbon emissions in the supply chain.

A recurring problem has also been the lack of reporting beyond first-tier suppliers. But as governing bodies and investors demand further due diligence, these current shortcomings become no longer acceptable. Our ESG risk data from more than 100 countries and regions shows transparency and human rights violations from suppliers beyond tier-1 continues to be a problem worldwide, highlighting the importance of gaining better visibility of risks along the entire supply chain.

Changing Perspective

While we recommend several strategies to improve reporting procedures, the most critical change we encourage is a mindset shift. Sustainability executives must view reports as a channel for promoting organisational change and improvement, rather than a misleading piece boasting false efforts. After changing this mindset, executives can then focus on steps to improve the report itself to align with the needs of the business, stakeholders, regulation requirements, and consumers:

- Choose the right framework: The plethora of reporting frameworks available for companies covering different ESG scopes and topics have created confusion for organisations. Understanding your company’s scope and targets will help you choose the framework that will best align with your intent. The International Sustainability Standards Board (ISSB) released in June two new disclosure standards for companies reporting on climate and sustainability-related risks and opportunities. The standards were created to promote better global alignment and could be a good start for entities choosing a framework.

- Engaging third party assurance: Third-party assurance enhances the credibility of a company’s ESG disclosures. As regulatory expectations for ESG disclosure increase, third-party assurance can also help ensure that a company’s reporting is in line with relevant laws, standards, and guidelines.

Organisations have a unique opportunity to spearhead modelling best practices for impact reports and create meaningful impact and foundational improvements.