Learn how calculating labor cost components can prevent human rights violations in supply chains. Explore the importance of itemizing labor costs to ensure fair wages, in alignment with global initiatives like ACT on Living Wages.

A living wage is a human right. According to the UN Declaration of Human Rights, “everyone who works has the right to just and favorable remuneration ensuring for [themselves] and [their] family an existence worthy of human dignity (…)”. However, wages paid in supply chains are often too low to ensure that workers and their families can live in dignity, and wage systems in global supply chains thus pose the risk of violating human rights. A company alone cannot change a national minimum wage system. But it can list labor costs separately in purchasing prices in order to mitigate the human rights risk that the factory pays too low wages.

Improving wages in supply chain is a key issue for many sectors

The payment of decent wages in supply chains has always been a pressing issue for the workers. As a result various large companies have committed to ensuring that a living wage is paid to workers in their supply chains. For instance, last year Unilever set the goal to “ensure that everyone who directly provides goods and services to Unilever will earn at least a living wage or income by 2030”. In the apparel sector most social standard initiatives (such as: FWF, ETIs, FLA, HIGG BRM or ACT on Living Wages) are asking their members to implement living wages and are providing support in doing so.

Purchasing practices often prevent the payment of minimum or living wages

The implementation of living wages in global supply chains is a complex issue, and simply requesting from a supplier to pay living wages is unlikely to be successful. One reason is that the current purchasing prices often prevent the factories from paying living wages and in some cases even minimum wages. For instance, a survey by the ILO found that in 55% of the cases suppliers sold below costs for various reasons (e.g. to secure future business, to keep advantages over competitor, because of threats by customers, or because of mistakes in their own calculations). If current purchasing prices prevent factories from paying minimum or living wages, how can brands and suppliers start to mitigate these human rights violation?

Brands and retailers should itemize labor costs and ensure that factories pay them

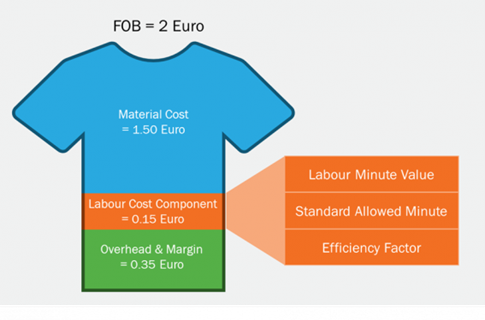

One first step brands and retailers can take to prevent that purchasing prices are too low to pay minimum or living wages is to itemize and separate the so called “labor cost component” (LCC) of the purchasing price. The ACT initiative on Living Wages is asking its 19 company members to commit that “purchasing prices include wages as itemized costs”. What does this mean? For instance, a factory offers a T-Shirt for 2,00 Euros (free on board – FOB price). The material costs 1,50 Euro. Based on the current efficiency rate of the factory, Standard Allowed Minutes and information regarding labor minutes and values, a company can calculate the labor cost component (LCC) – i.e., the money the factory needs to pay the required wages. In this example the LCC is 0,15 Euros. Material costs are usually non-negotiable, and the labor cost component should also be non-negotiable. Therefore, the only way the brand or retailer could bargain on the price is to cut the factories’ overhead costs / margins (in the example 0,35 Euros) or to argue that the supplier needs to work more efficiently – or the brand or retailer must adjust its price accordingly. Itemizing labor costs in the FOB and price negotiations allows the brand or retailer to provide the factory with the labor costs they require to pay decent wages and it can prevent them from requesting too low prices.

Picture: Example of calculating the labor cost component of a t-shirt

Picture: Example of calculating the labor cost component of a t-shirt

LRQA (formerly ELEVATE Ltd) supports companies in calculating and auditing labor costs

LRQA (formerly ELEVATE Ltd) trains companies in calculating the labor cost component (LCC) according to ACT requirements, which allows them to separate LCCs in their price negotiations. Suppliers who fear that buyers might misuse transparent pricing to strengthen the pressure on them might be reserved to disclose a fully transparent costing. For this purpose, LRQA (formerly ELEVATE Ltd) is piloting wage cost audits which work as follows:

- A factory makes the labor costs transparent for LRQA (formerly ELEVATE Ltd), but not for the brand or retailer.

- LRQA (formerly ELEVATE Ltd) then assesses whether the FOB including the itemized labor cost component allow the factory to pay decent wages and shares the findings with the factory.

- LRQA (formerly ELEVATE Ltd) gives feedback to the brand or retailer if their prices allow for the payment of living wages. If it does not, the brand or retailer knows that their FOB price is too low.

With this feedback, brands and retailers then have the transparency and can adjust prices to allow the payment of living wages. This is a first step to securing the human right of paying living wages.